We provide standard and customized training courses, depending on the digital maturity and ESG culture of the company and the current needs, to share relevant knowledge about sustainability management, digital transformation and performance management.

The main focus of our consulting team is to support the client through the journey of building solid and flexible data architectures able to facilitate the ESG reporting and to generate knowledge about performance drivers with the help of technology.

EmissionX is a state of the art platform for the calculation, reporting and accounting of the carbon print, employing A.I. and machine learning to integrate ESG into the overall performance framework.

EDUCATIONAL TOPICS – SUSTAINABILITY

CONTEXT

METHODOLOGY

OUTCOMES

CONTEXT

METHODOLOGY

OUTCOMES

CONTEXT

METHODOLOGY

OUTCOMES

Businesses require high-quality, fast data to make good decisions. This is why we have developed A.I. engines for multiple use-cases such as: capturing and validation of data, mapping, matching and association of different variables, determining correlations between separate variables, forecast generating.

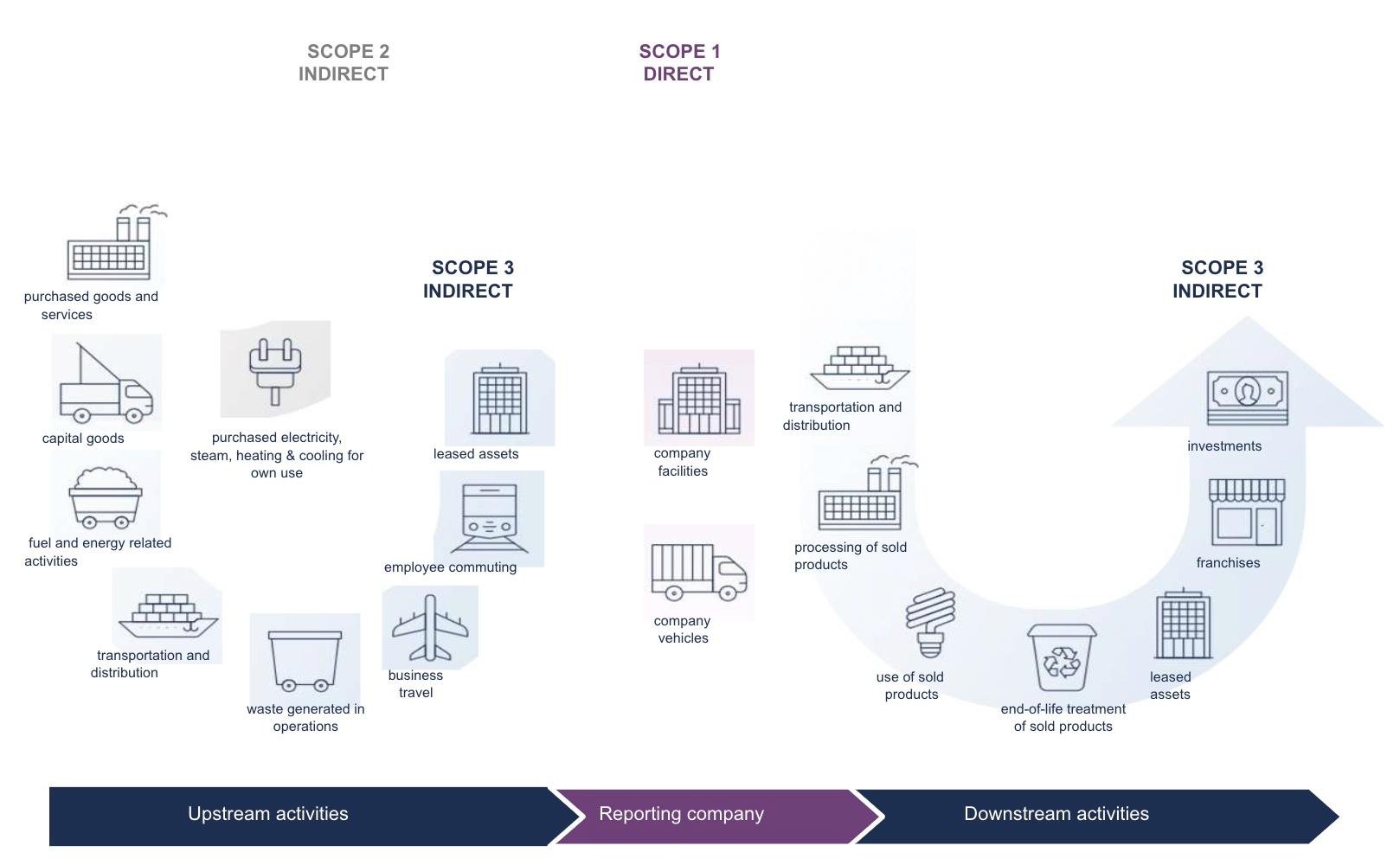

EmissionX solution helps companies calculate and report GHG emissions in accordance to GHG Protocol and applicable European standards (CSRD / EFRAG). The list of supported KPIs is continuously updated and can be customized at client level.

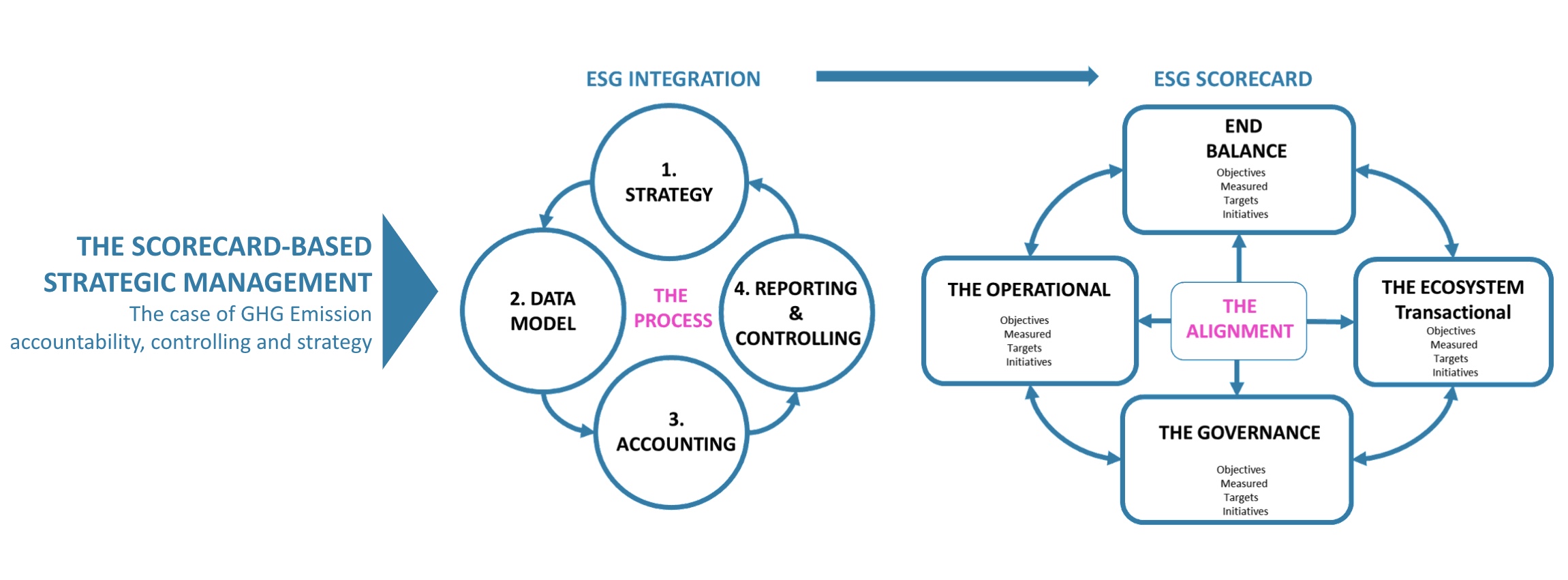

The flexible data architecture supports different certified methodologies of emissions accounting and reporting. The Sustainability Accounting Module of EmissionX allows the definition and allocation of emissions at process level, making it possible to calculate the carbon print of individual products and services.

In the Strategic Management module companies can define ESG performance indicators and determine correlations between input and output indicators with the help of our A.I. engine. EmissionX helps companies define the 2030 and 2050 decarbonization targets, based on their real time, actual data.